This is the first ina a series of articles on the future of the finance function.

Finance functions face constant pressure to evolve in response to the ever-changing business environment. Although this evolution has no endpoint, forward-looking CFOs need to understand what a successful, value-adding finance function will look like in ten years.

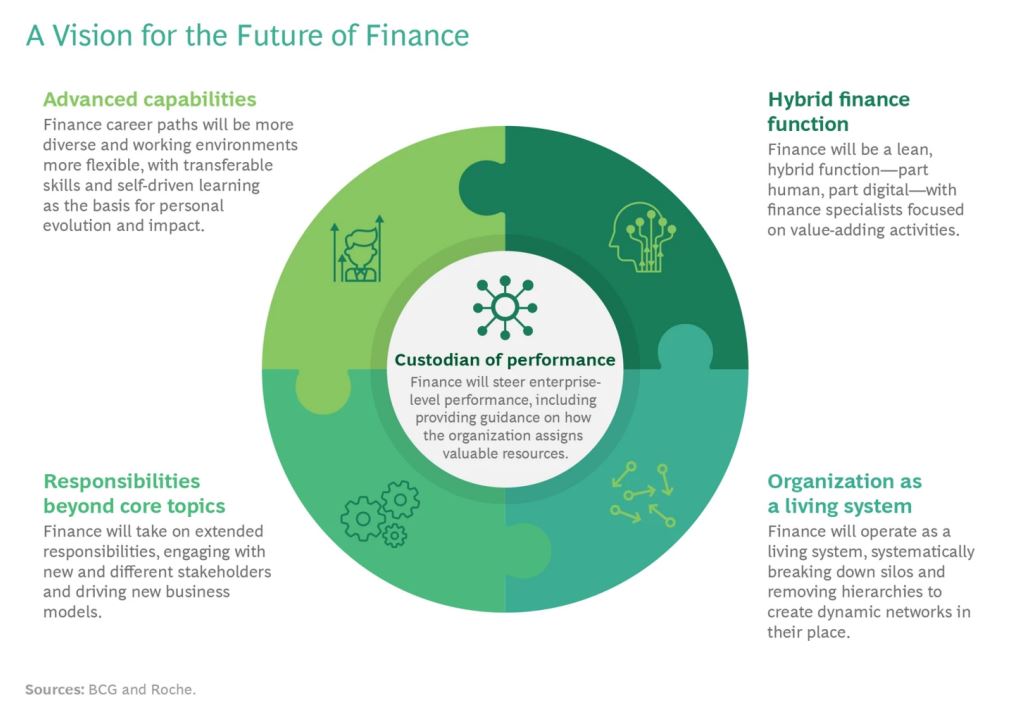

Drawing upon our experience and our exchanges with leading CFOs, we have developed a near-term vision for the future of finance. (See the exhibit.) As its overarching role, finance will become the custodian of performance. The function is uniquely positioned to steer enterprise-level performance, including providing guidance on how the organization allocates valuable resources. To fulfill this role, the finance function should change how it works and operates in four main ways.

We believe that this vision not only serves as an inspiration, but also helps finance functions in setting clear targets for their near-term evolution.

The Overarching Role: Custodian of Performance

As business models become more complex, a company needs a “custodian of performance” to steer performance holistically and objectively in the best interest of the entire organization. This role extends beyond what academics and practitioners typicallymdescribe as performance management—such as forecasting, planning, budgeting, tracking KPIs, and reporting. We view these elements as only basic enablers for custodians to fulfill their role.

The custodian steers performance to achieve the company’s purpose. Roche, for example, has articulated its corporate purpose as “doing now what patients need next.” Ideally, each decision entails making the optimal trade-off of resources—among business units, between business units and functions, and among functions— to fulfill this purpose. The custodian seeks to solve this multidimensional problem of resource allocation holistically.

Although focusing on the corporate purpose increases the complexity of decision making, the payoff in terms of business impact is significant.

To steer performance based on the corporate purpose, CFOs need to broaden their perspective beyond traditional financials. For example, sustainability and societal impact have become increasingly important considerations. CFOs can integrate these topics— often referred to as environmental, social, and governance (ESG) factors—into performance steering. This extends well beyond the disclosure requirements and investor expectations that CFOs have typically considered in connection with ESG.

To steer performance based on the corporate purpose, CFOs need to broaden their perspective beyond traditional financials, considering such issues as sustainability and societal impact

The Four Enablers

Four enablers support the finance function as the custodian of performance

1. Hybrid Finance Function

It is clear that digitization is fundamentally disrupting finance. In their initial applications of digital, companies seek to reduce manual work by standardizing, optimizing, and almost fully automating their main finance processes from end to end. At the same time, they improve the availability and accessibility of data. Most companies have already embarked on this stage of the journey.

After mastering the first stage, finance organizations should move toward “hybrid finance”—a symbiosis of finance specialists and the digital ecosystem that includes artificial intelligence, machine learning, and advanced analytics. By integrating finance employees and digital capabilities, the finance function can use the digital ecosystem not only to promote efficiency, but also to perform value-adding tasks. In our view, every CFO’s agenda should include evolving from efficiency-focused digitization to hybrid finance.

Examples of how hybrid finance delivers value include:

- Providing initial hypotheses on the appropriate actions to take based on data-driven insights and pinpointing important questions to ask.

- Performing independent tasks (such as hedging) that do not entail repetitive work or clear rules.

- Conducting complex simulations relating to, for example, the interrelationships among cash, taxes, and the balance sheet

Hybrid finance also creates new roles in the finance function, as finance employees need to administer the digital ecosystem and perform “sanity checks” to ensure the quality of, for example, forecasts and simulations.

2. Organization as a Living System

The finance function needs a fundamentally new operating model to support the custodian of performance. The end-to-end optimization and digitization of processes give rise to a networked organization that forms a living system. In this organization, the remaining manual tasks are fully transferred to global business services as well as to shared resources, such as automation experts, project managers, or business process owners. The boundaries between functions and business units further diminish. Work becomes functionally agnostic, less focused on specific deliverables, and performed more dynamically and iteratively.

The end-to-end optimization and digitization of processes give rise to a networked organization that forms a living system.

Content produced by Boston Consulting Group